A Quick Guide to Bukas All-Year Plans for PHINMA Students

What is a Bukas All-Year Plan?

With Bukas All-Year Plans, we can cover up to 100% of your tuition fee.

Who can apply for a Bukas All-Year Plan?

All students (freshmen, upper years, transferees, and returnees) enrolling to college programs and graduate studies can apply for a Bukas All-Year Plan, kahit nakapag-downpayment ka na!

How can I apply for a Bukas All-Year Plan?

There are only THREE easy steps needed in order to apply:

STEP 1: Register

- Pumunta sa app.bukas.ph at mag-login. Kung wala ka pang account, mag-register at mag-fill out ng iyong profile.

- Verify your identity by preparing a valid ID and completing the Liveness Test.

- We accept the following IDs: student ID, passport, driver’s license and UMID

STEP 2: Submit

- Prepare the following requirements:

- Co-Borrower

- Additional Contact Person

- Both individuals have to be 18yrs old and above and residing in the Philippines.

- They can be your parent or guardian but CANNOT be OFWs

- Source of Income

- This can be your or your Co-Borrower.

- If you receive remittance from an OFW, the receiver of the remittance is the source of income.

- Prepare the following requirements:

- Proof of Residence - Utility (Meralco, water, or interne) bills, or Barangay Certificate

- Proof of Income - Payslip, Certificate of Employment, bank statements. For those earning from OFWs, prepare your Proof of Remittance

- Tuition Document - Screenshot from student portal of last semester's fees, upcoming semester's advising slip

- On the Home tab of your Bukas account, just select the College Loan button to start your application!

Fill out the application form and submit.

NOTE: Siguraduhing na-click ang “SUBMIT” button para magkaroon ng valid Bukas application.

In 1-2 working days we will let you know if your application has been PRE-APPROVED.

Pre-approved borrowers will need to upload the documentary requirements. Please advise your Co-borrower that a link will be sent to them for verification. Without this, we will not be able to proceed with your application.

You will receive the FINAL RESULTS of your application in 3-5 business days.

STEP 3: Confirm

- After submitting, wait for our SMS and email in case there are needed revisions.

- Once approved and the loan contract is ready, you and your Co-Borrower need to confirm the agreement with us by logging in at app.bukas.ph and through the signing SMS we sent, respectively.

You're at the end of the process! We will reach out to you via SMS or e-mail with the next steps.

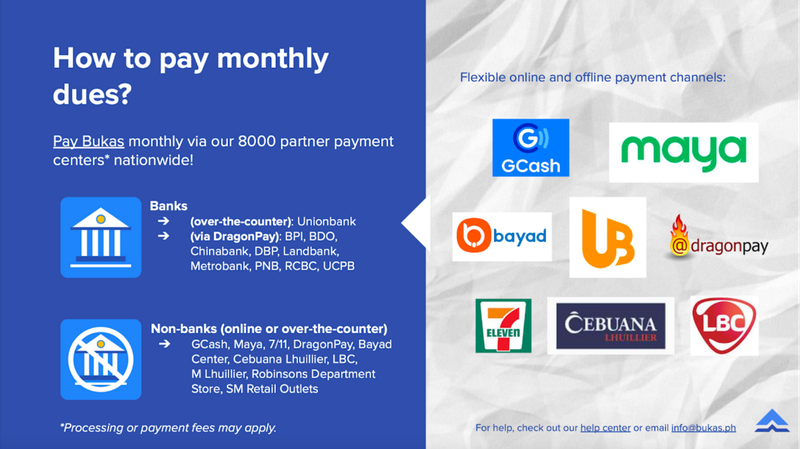

How do I pay for my monthly dues with Bukas?

Currently, you can pay via GCash, Maya, Unionbank over the counter, Unionbank online, RCBC Online Banking, RCBC over the counter, official Bayad Center branches, and through over 3,000 DragonPay partner channels, either online or over-the-counter (BPI, BDO, Metrobank, RCBC, 7-Eleven, SM Dept. Store, Cebuana Lhuillier, M. Lhuillier, etc.).

Check this page for more information.

When will I start paying for my Bukas All-Year Plan?

Your first due date and repayment calendar will be seen on your payment dashboard once you log in at bukas.ph after disbursement or the activation of your plan.

Once logged in, tap on "My Loans" tab, click your Reference Code, and scroll down to see your repayment schedule.

Have questions about Bukas All-Year Plan?

For assistance, you can reach out to the following:

- In-campus: CSDL offices

- Reach out to us at https://bukas.ph/contact-us/

Tips on how to fast-track your application with Bukas:

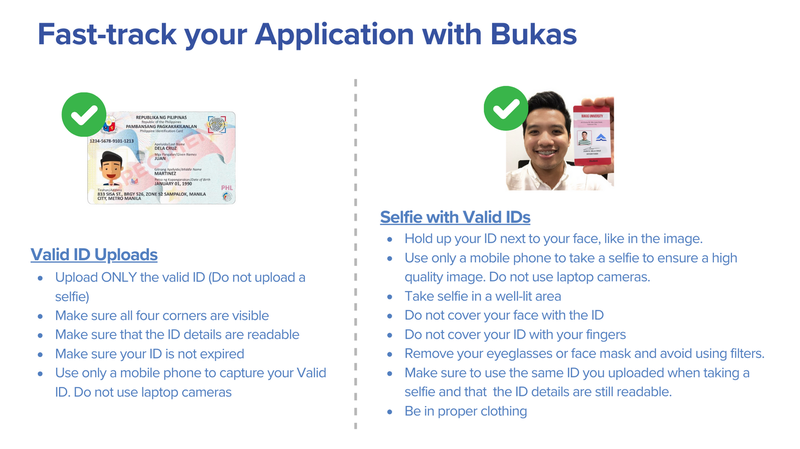

When uploading your VALID ID:

- Upload ONLY the valid ID (Do not upload a selfie)

- Make sure all four corners are visible

- Make sure that the ID details are readable

- Make sure your ID is not expired

- Use only a mobile phone to capture your Valid ID. Do not use laptop cameras.

When taking a SELFIE with your VALID ID:

- Hold up your ID next to your face, like in the image.

- Use only a mobile phone to take a selfie to ensure a high quality image. Do not use laptop cameras.

- Take selfie in a well-lit area

- Do not cover your face with the ID

- Do not cover your ID with your fingers

- Remove your eyeglasses or face mask and avoid using filters.

- Make sure to use the same ID you uploaded when taking a selfie and that the ID details are still readable.

- Be in proper clothing

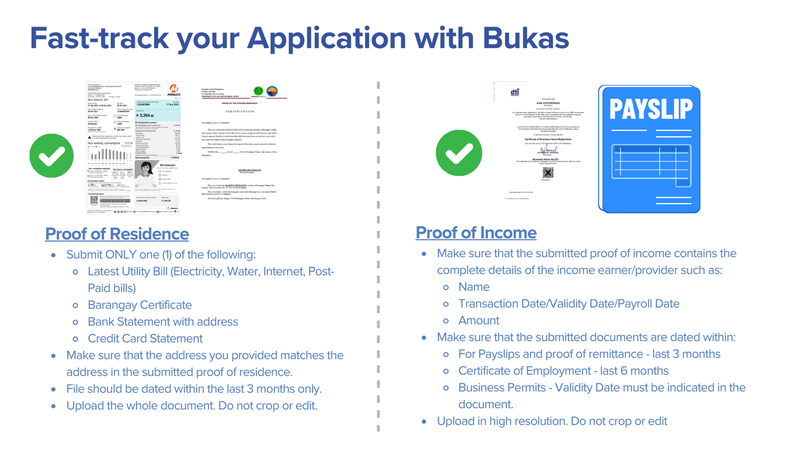

When uploading your Proof of Residence:

- Submit ONLY one (1) of the following:

- Latest Utility Bill (Electricity, Water, Internet, Post-Paid bills)

- Barangay Certificate

- Bank Statement with address

- Credit Card Statement

- Make sure that the address you provided matches the address in the submitted proof of residence.

- File should be dated within the last 3 months only.

- Upload the whole document. Do not crop or edit.

When uploading your Proof of Income:

- Make sure that the submitted proof of income contains the complete details of the income earner/provider such as:

- Name

- Transaction Date/Validity Date/Payroll Date

- Amount

- Make sure that the submitted documents are dated within:

- For Payslips and proof of remittance - last 3 months

- Certificate of Employment - last 6 months

- Business Permits - Validity Date must be indicated in the document.

- Upload in high resolution. Do not crop or edit

For Co-borrower or Additional Contact Person’s Consent

To ensure a fast and successful verification process, make sure to:

Submit now! Just log in to your Bukas account and select the College Loan button on your Home tab to get started.

Note: This article is valid to ALL PHINMA campuses in the Philippines (except SWU and COC campuses).